What is a Payroll System?

A payroll system is software which organizes all the tasks of employee payment, benefits, and the filing of employee taxes.

These tasks can include keeping tracking of days worked, calculating wages, leave records , overtime payments , statutory

deductions, printing and delivering checks and paying employment taxes to the government.

Payroll software often requires very little input from the employer. The employer needs to input employee wage information and hours in the Master —then the software calculates every desired report automatically.

10 Steps to Setting Up a Payroll System

Whether you have one employee or 1000, setting up a payroll system not only streamlines your ability to stay on

top of your legal and regulatory responsibilities as an employer, but it can also save you time and help protect

you from incurring costly Internal Revenue Service (IRS) penalties.

Here are 10 steps to help you set up a payroll system for your small business.

-

Some state/local governments require businesses to obtain ID numbers in order to process taxes.

-

Be clear on the distinction between an independent contractor and an employee.

In legal terms, the line between the two is not always clear and it affects how you withhold income taxes, withhold and pay Social

Security and Medicare taxes, and pay unemployment taxes.

-

New employees must fill out Federal Income Tax Withholding Form W-4. Your employee must complete the

form and return it to you so that you can withhold the correct federal income tax from their pay.

-

You may already have a manual process for this, but setting up a pay-period (whether monthly or bi-monthly) is

sometimes determined by state law with most favoring bi-monthly payments. The IRS also requires that you withhold income tax for that

time period even if your employee does not work the full period.

-

As you set up payroll, you’ll also want to consider how you handle paid time off

(not a legal requirement, but offered by most businesses), how you track employee hours, if and how you pay overtime, and other business

variables. Don’t forget that other employee compensation and business deductibles such as health plan premiums and retirement contributions

will also need to be deducted from employee paychecks and paid to the appropriate organizations.

-

Payroll administration requires an acute attention to detail and accuracy, so it’s worth doing some research to

understand your options. Start by asking fellow business owners which method they use and if they have any tips for setting up and

administering payroll. Typically, your options for managing payroll include in-house or outsourced options. However, regardless of the

option you choose, you -- as the employer -- are responsible for reporting and paying of all payroll taxes.

-

Once you have all your forms and information collated, you can start running payroll. Depending on which payroll system

you choose, you’ll either enter it yourself or give the information to your accountant.

-

Federal and some state laws require that employers keep certain records for specified periods of time. For

example, W-4 forms (on which employees indicate their tax withholding status) must be kept on file for all active employees and for

three years after an employee is terminated. You also need to keep W-2s, copies of filed tax forms, and dates and amounts of all tax deposits.

-

There are several payroll tax reports that you are required to submit to the appropriate authorities on either a

quarterly or annual basis. If you are in any way confused about your obligations, take a look at our system, which provides some very

clear guidance on all federal tax filing requirements.

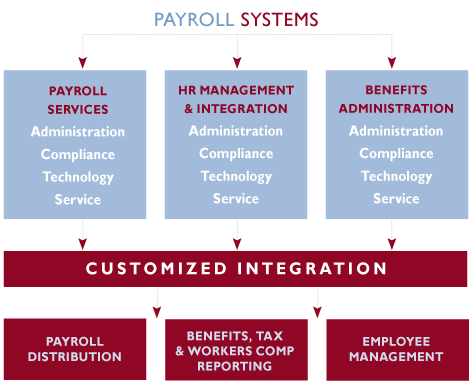

Choosing a Payroll System

Choosing a payroll system that best fits your business is essential. It may be difficult to decide which system to choose, but there are some factors to keep in mind when deciding. First, analyze the size of your business and how much of your budget you are willing to spend on payroll processing.

While it is possible for smaller businesses to handle payroll duties in-house through a manual process, a lot of time can be wasted attempting to calculate everything correctly. One miscalculation and the business owner could find themselves in legal or financial trouble. Mid-sized companies with up to 100 employees benefit greatly by investing in a payroll system.

Find a New Payroll System

Are you ready for a new payroll system? Our 100% free service matches you with vendors who can meet your payroll software needs.